With the implementation of government regulations starting in 2025, the VAT rate will increase to 12%. This article is designed specifically to assist SAP Business One users in making adjustments related to this VAT rate change.

Methods for Adjusting the VAT Rate

- Adding a New Rate to an Existing Tax Code

- Advantages: This method makes it simple to apply the new rate across all transactions.

- Disadvantages: It does not allow for the selection of alternative VAT rate variants.

- Creating a New Tax Code with the Updated Rate

- Advantages: This method enables you to maintain the flexibility to choose different VAT rate variants.

- Disadvantages: It requires additional configurations to set the new tax code as the default for transactions.

Method 1

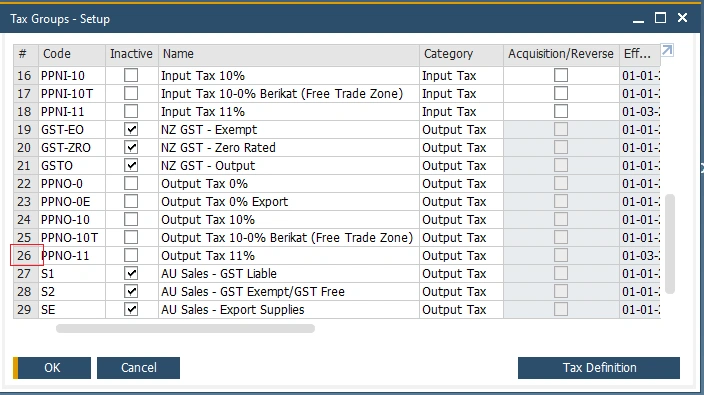

- Access the TaxGroup menu via: Administration → Setup → Financial → Tax.

- Double-click the number field of the tax code where you want to add the new rate, as shown in the following image.

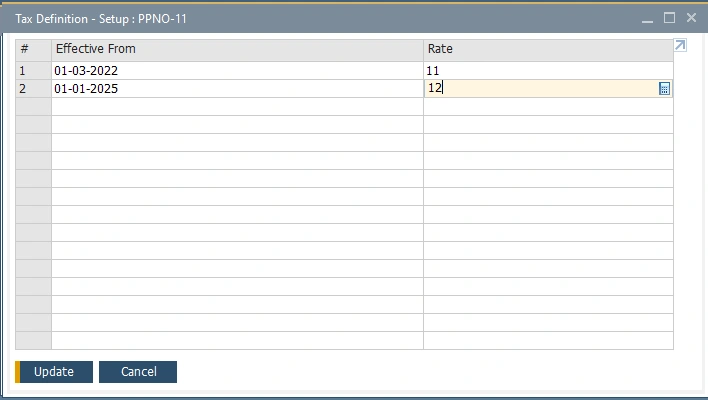

- In the Tax Definition window for the selected Tax Code, enter the Effective From date and the new Rate as needed.

- Once completed, update the Tax Definition and the Tax Group.

Method 2

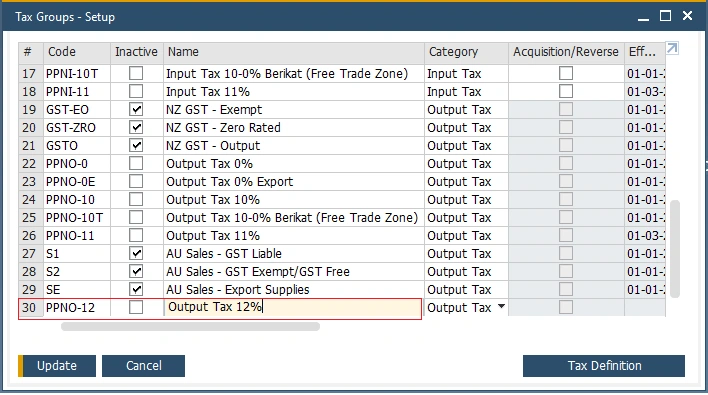

- Access the TaxGroup menu via: Administration → Setup → Financial → Tax.

- Enter a new Code and Name, and to facilitate future use, include “12” in the naming convention.

- Double-click the number field of the newly created Tax Code to open the Tax Definition window.

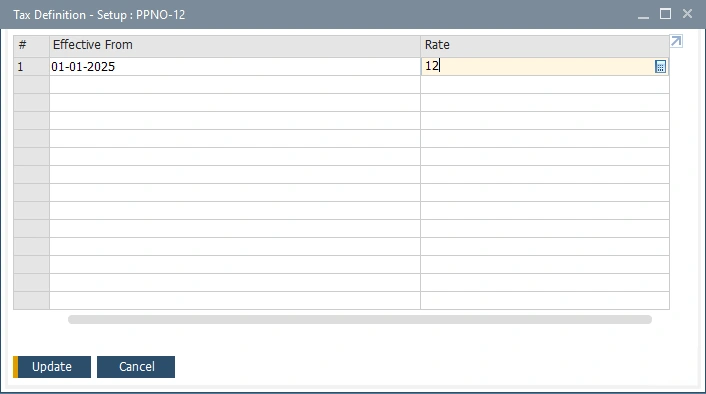

- Enter the Effective From date and the new Rate as required.

- Update the Tax Definition and the Tax Group once changes are made.

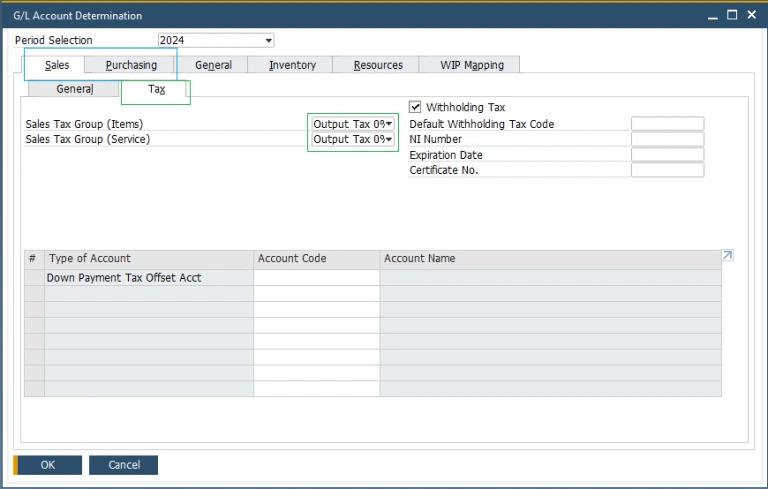

- Configure the new Tax Code as the default by adjusting the settings in the G/L Account Determination menu: Administration → Setup → Financial → G/L Account Determination.

- Apply the settings for both purchasing and sales transactions as demonstrated.

- Finalize the process by updating the configuration.

These are the steps to add the new VAT rate. Feel free to choose either method based on your requirements.